Understanding Luxury Car Rental Insurance: How It Works

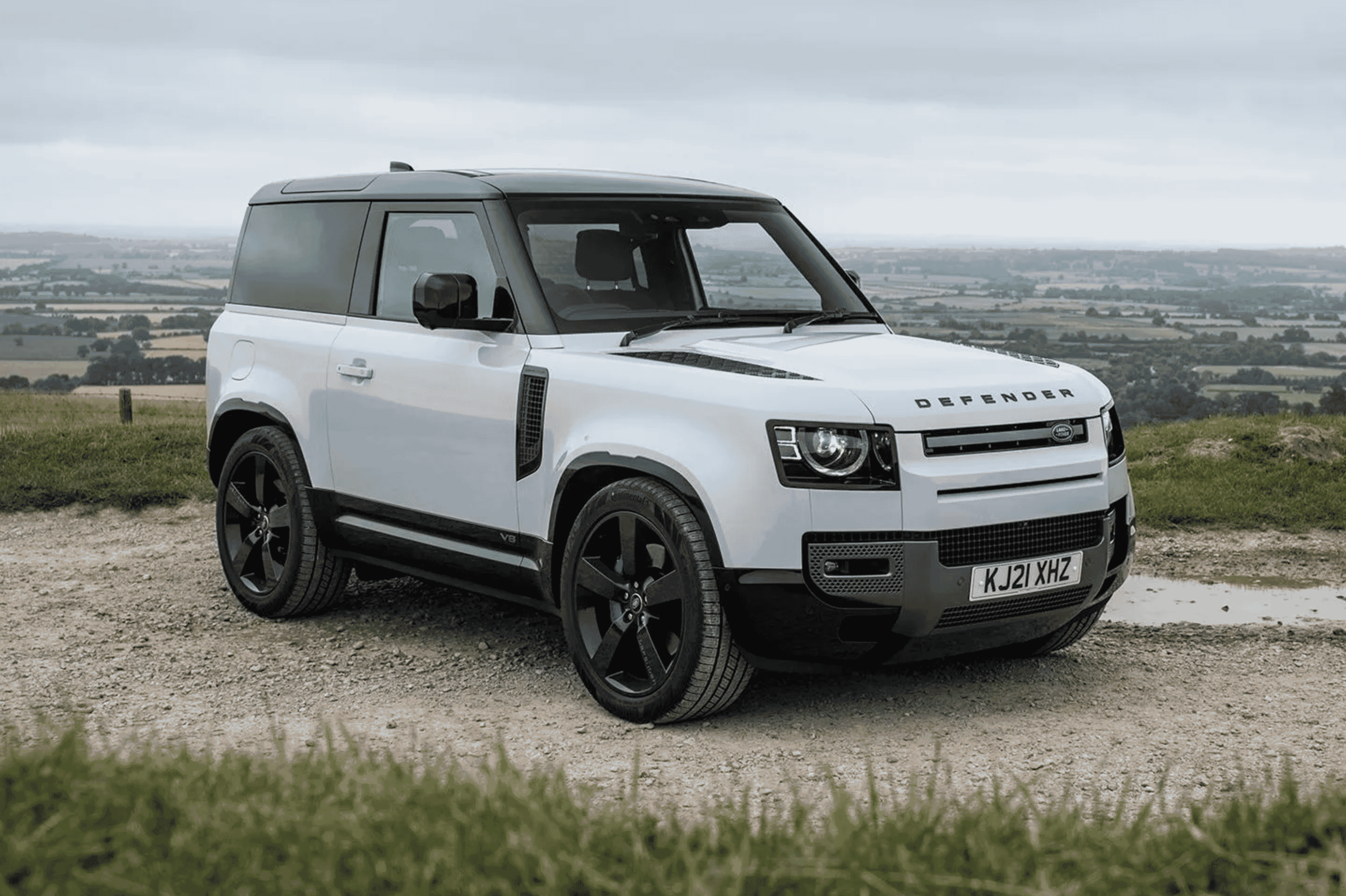

When you’re planning to visit the France, Switzerland, Italy, Germany, Spain or any other travel destination, renting a luxury car can provide an extraordinary experience. It offers comfort, style, and a sense of indulgence. However, it’s essential to understand how luxury car rental insurance works before you zoom off in your dream vehicle.

The Importance of Luxury Car Rental Insurance

Luxury car rental insurance protects you from financial losses in case your rental vehicle suffers any damage. It covers the cost of repairs and even the replacement of the vehicle in case of theft or total loss. But the luxury car rental insurance can be a bit complex, particularly when it comes to the security deposit and insurance deductible. Let’s delve into these aspects to help you better understand.

Security Deposit and Insurance Deductible

When you rent a luxury car, you are required to authorize your credit card with a security deposit. This deposit is usually equivalent to the insurance deductible, also known as insurance excess.

The security deposit acts as a guarantee for the car rental company that you will cover any potential damages up to the deductible amount. Once you return the car in the same condition as you received it, the security deposit will be refunded in full. If you damage the car for 500€ you will only pay 500€ as the cost is below the 3000€ deductible amount.

Types of Insurances Included in Luxury Car Rentals

1. Third-Party Liability

Third-party liability insurance is a legal requirement for all vehicles, including luxury car rentals. It covers any damage or injury you might cause to other road users or property while driving the rental car. This insurance does not cover any damage to the rental vehicle itself, unless a third-party insurance is responsible for those damages. In that case, a Police or Insurance Report is required in order to submit a claim to the third-party insurance.

2. Full Kasko Insurance with Deductible

Full Kasko Insurance, also known as Collision Damage Waiver (CDW), covers damage to the rental car. It’s a comprehensive cover that ensures the vehicle is insured totally. However, it comes with a deductible.

The deductible is the portion of the repair or replacement cost that you, as the renter, would be responsible for. If you have Full Kasko Insurance with a deductible of 3000€, and if the rental car suffers damage worth 7000€, you would only pay 3000€, while the insurance would cover the remaining 4000€.

This insurance is critical to have as it reduces your financial liability in case of any accidental damage to the luxury car.

Can I Reduce my Liability?

Yes, you may reduce your liability up to 50% the Deductible Amount, by paying an extra fee on the daily car rental price. Request this to our Staff and we will include it in the Quote.

A Tip for your Next Luxury Car Rental

While you can reduce the liability of the Insurance Deductible, on Luxury Cars you will always be liable for some amount. Before booking we suggest you to verify with your Credit Card provider if they offer a coverage in case of damages to the car. Many Credit Card Companies do offer this type of insurance for their valuable clients. This way, in case of damages, you can have a reimboursement from your Credit Card Institute.

Conclusion

Renting a luxury car offers an unmatched travel experience, but it also comes with certain responsibilities. Understanding how luxury car rental insurance works is crucial to protect yourself from potential financial losses. Always remember to read and understand the terms and conditions of your rental agreement and insurance policy. And, most importantly, drive safely and enjoy your luxurious ride in style and comfort.

I'm Ready to Find a Luxury Car Rental for My Next Trip